Buying Gold and Silver in the USA from Provident Metals

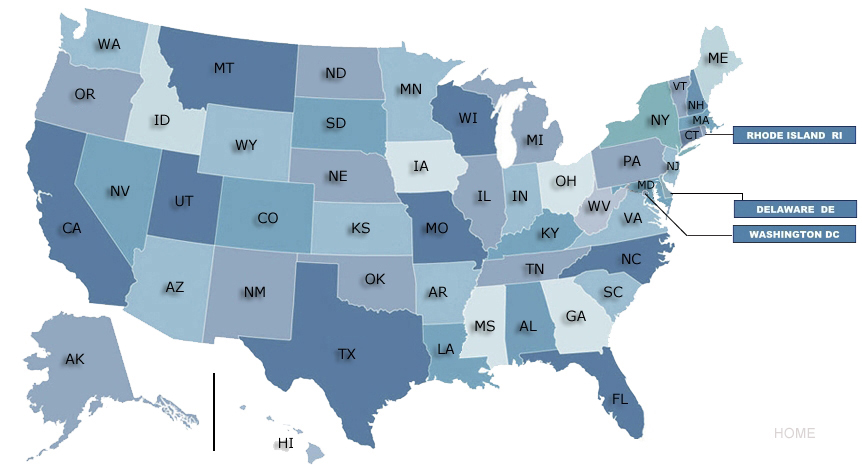

When you purchase your favorite gold and silver bullion products from Provident Metals, you’re in some cases required to pay local sales tax on your purchases. Because local sales tax rates are based upon the address we’ll be shipping your bullion products to, there is often confusion for consumers about what their eventual total will be. To clear up the confusion, we’ve created an interactive directory that lets you research your state’s sales tax rules and regulations so you know in advance what to expect. Please note that your sales tax is dependent upon where we are shipping your bullion, and not necessarily your home address. If you store your gold and silver bullion somewhere other than your home state, please make sure to check the sales tax rates for that location.

Why the Change in Tax Collection?

On June 21, 2018, the Supreme Court of the United States announced a decision in the South Dakota v. Wayfair Inc. case. In short, South Dakota argued that it was losing out on local sales taxes as consumers spent more money shopping online rather than in brick-and-mortar locations. The 1992 Quill Corp v. North Dakota case had set a precedent for how states would eventually deal with online retailers. Back then, the court ruled in favor of Quill Corp, which it agreed did not need to collect sales tax on sales in North Dakota because it had no physical presence in the state.

The June 21st decision in 2018 by SCOTUS wipes out that precedent and opens the door for states to begin forcing online retailers to collect and remit local sales taxes. Online retailers are now forced with adapting to a variety of different sales tax rates and rules across the nation. At Provident Metals, we’re adjusting to the changes and working to make it easier for our customer base to gain a clearer understanding of their total sales figure before a purchase is complete.

We’ve developed our interactive menu to help you figure out what type of sales tax, if any, you’ll face.

What We’re Doing at Provident Metals to Clear the Confusion

At Provident Metals, we’re taking concrete steps to help you better understand how your purchase of gold, silver, platinum, palladium, and copper is impacted by the sales tax change. First and foremost, we’re only charging sales tax in some states. Within those states, there are distinctions based upon the type of product. Some states do not charge for the purchase of bullion coins, while others charge for numismatic products and accessories such as flips, capsules, and apparel.

Here’s an example of some of the differences:

- Texas requires a sales tax to be collected on certain non-bullion items shipped to a Texas address by Provident Metals, with the tax impacting copper products, palladium products, and accessories such as coin holders, tubes, flips, and apparel.

- Vermont, on the other hand, requires Provident Metals to collect a sales tax on all products shipped to a Vermont address.

At Provident Metals, we encourage you to take a moment and use our interactive map before you buy so you know exactly what you’ll be charged for sales tax on your purchase. Our goal is to clear up the confusion for you so you have a better idea of how much you’re spending on your favorite precious metal items.

As your trusted partner in the bullion industry, we are committed to providing exceptional precious metals products, fast shipping, and the highest-quality customer service in the industry. We invite you to explore what we have to offer, and experience the Provident Metals difference for yourself.

Shop Now