Silver Bullion Coins, Bars, and Rounds at Provident Metals

Silver is one of the most popular precious metals to invest in due to its availability, affordability, and all the unique options that are present. Silver is available in coins, bars, rounds, statues, shot, bullets, and more. With so many options to choose from, learn more about Silver Bullion Coins, Bars, and Rounds before you invest, right here at Provident Metals.

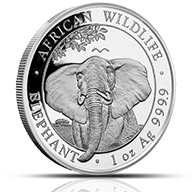

Silver Coins

The most popular form of silver on the market today is Silver Coins. These coins have their purity, weight, and metal, backed by a central government. At Provident Metals, you’ll find no shortage of unique silver coins readily available to be purchased. Among the most popular options are the following:

- American Eagle Silver Coins: Struck annually by the US Mint since 1986, this coin program is the most popular silver bullion coin on the market today. These coins are struck in just a 1 oz weight with a purity of .999 pure silver. The obverse field features the iconic Walking Liberty design of Adolph A. Weinman while the reverse showcases the John Mercanti heraldic eagle (1986-2021 Type 1) or the flying eagle of Emily Damstra (2021 Type 2 – Present.)

- Australian Kangaroo Silver Coins: Despite this coin series not starting until 2016, this series from the Perth Mint was the first from the well-known mint to be struck with a .9999 pure silver purity. These BU coins feature the same Red Kangaroo design on the reverse with the reigning British monarch on the obverse. Queen Elizabeth II was seen on the obverse from 2016 to 2023 while King Charles III’s image can be seen on coins with an issuing date of 2024, and on.

- Austrian Philharmonic Silver Coins: The Austrian Mint has struck these Philharmonic Silver Coins annually since 2008. These coins came nearly two decades after the debut of the gold coins in this series, giving investors and collectors another viable option. These coins showcase the pipe organ in the Musikverein on the obverse and a collection of instruments on the reverse. During a five-year span from 2008 to 2012, this coin program sold well over 54 million silver coins.

- British Britannia Silver Coins: The official silver bullion coin of Great Britain is the British Britannia Silver Coin, struck annually by the Royal Mint. These coins display the image of Britannia, the female personification of Great Britain, on the reverse along with the reigning British monarch on the obverse. Three different renditions of Queen Elizabeth II have been seen on these coins including depictions by Raphael Maklouf (1997) Ian Rank-Broadley (1998-2015) and Jody Clark (2016-2022.) Coins with an issuing date of 2023, and on, will showcase Martin Jennings depiction of King Charles III.

- Canadian Maple Leaf Silver Coins: Another popular option is the Canadian Maple Leaf Silver Coin, which is among the most popular silver bullion coins in the world. These coins are struck by the Royal Canadian Mint and have been issued annually since 1988, nearly a decade after the gold coins in this series debuted. Like British Britannia Coins, these coins have seen three unique depictions of Queen Elizabeth II, including Arnold Machin’s rendition (1988-1989) Dora de Pédery-Hunt’s depiction (1990-2003), and Susanna Blunt’s (2004-2023.) Coins with the issuing date of 2024, and on, will feature the portrait of King Charles III by Steven Rosati.

- Chinese Panda Silver Coins: One of the more unique annual bullion coin programs is the Chinese Panda Silver Coin, issued by the Chinese Mint. The series debuted in 1983, only as a proof strike. The series released no coins in 1986 and 1988. Since 1989, these coins have been issued by the Chinese Mint as an investment-grade bullion silver coin. These coins showcase unique images of a panda on each release.

- Mexican Libertad Silver Coins: Struck by the Mexican Mint, Libertads are unique in that they technically don’t have a face value. These silver coins feature the Mexican coat of arms on the obverse with a depiction of Winged Victory on the reverse. These coins are also available in proof and reverse proof strikes.

- South African Krugerrand Silver Coins: The South African Krugerrand Gold Coin is the oldest modern gold bullion coin on the market. The success led to a silver coin release, but not until 2017. These coins feature the same design elements as their gold counterparts with Paul Kruger on the obverse and a Springbok antelope on the reverse.

Silver Bars

Another great option is Silver Bars. Silver bars are simpler in design but are more readily available due to all of the unique sizes that they come in. Silver bars remain a top choice for investors and collectors due to these weight options parlayed with their high purity. Some popular silver bar producers are the following:

- Asahi: Asahi acquired the precious metal refiners of Johnson Matthey in 2015. Since then, they’ve become a top name in the silver bar market for their wide array of minted ingots and cast bars. They have a line of American Reserve cast bars that are minted and refined in the USA.

- Geiger: Geiger is the oldest silver trading house in Germany as they were established in 1218 near Leipzig, Germany. Geiger is known for their square bars which are offered in sizes as large as 5,000 grams.

- Perth Mint: The Perth Mint has a wide range of minted ingots and cast bars in various sizes. Their minted ingots are distinguishable by the well-known Red Kangaroo design on the reverse.

- SilverTowne: Once a small coin shop in Indiana, SilverTowne is a top private mint in America. They have several high-quality silver bars and rounds for purchase with several bars displaying popular images on American coins.

- Sunshine Minting: With three locations throughout America, Sunshine Minting is one of the most popular private mints in the country. One popular option is their line of Mercury bars which features the well-known god on the obverse.

Silver Rounds

For those that want the intricate designs of silver coins, without breaking the bank, Silver Rounds are a great option as well. A round is a coin that lacks face value. Rounds aren’t backed by a central government meaning they’re typically offered at a lower premium than silver coins. These Rounds also, typically, don’t have a mintage cap. Some popular options we carry at Provident Metals are the following:

- Buffalo Nickel: The Buffalo Nickel was issued by the US Mint from 1913 to 1938. This iconic design can now be seen on the American Buffalo Gold Coin, as well as these silver rounds from SilverTowne and Sunshine Minting.

- Egyptian Gods Series: This collection of 2 oz silver rounds showcases popular figures from Egyptian culture on ultra-high relief rounds. Popular designs include Horus, Cleopatra, and Osiris among others.

- Medieval Legends: This unique series features images of popular folk heroes and figures from the Medieval Period. Popular rounds include Tristan & Isolde, the Pied Piper, and King Arthur, among others.

- Walking Liberty: Another popular coin design that can be seen on silver rounds is the Walking Liberty design of Adolph A. Weinman. These rounds are produced by popular private mints such as Sunshine Minting and SilverTowne.

- Zombucks: This interesting series features iconic coin designs, with an apocalyptic twist. Kangaruin showcases the Australian Kangaroo Silver Coin design but with rotting flesh. Meanwhile, the Pandamonium Round features the design of the Chinese Panda Silver Coin but with half of its body decaying.

Purchasing Silver Bullion Coins, Bars, and Rounds at Provident Metals

Contact the Provident Metals customer service team at 1-800-313-3315 with any questions you may have regarding Silver Bullion Coins, Bars, and Rounds. Our team can also be reached via email or through our online chat feature.