Gold Bars By Mint at Provident Metals

Gold bullion is available in coins, rounds, and bars. However, bars are a top choice for investors and collectors due to their weight, purity, and unique design choices. With many options, and even more mints to choose from, it’s important to be aware of every option sold at Provident Metals before purchasing. Learn all about gold bars and the mints that produce them, right here at Provident Metals.

Sovereign Mint Gold Bars VS Private Mint Gold Bars

Provident Metals offers gold bars from both sovereign and private mints. While both are great options, they each have specific benefits.

Privately minted gold bars are created by mints independent of a government entity. Typically, these gold bars have a lower premium and more creative designs. While Sovereign minted gold bars may have a higher price tag, they have the backing of a sovereign nation, for the gold content and purity only, giving you peace of mind when you buy.

Different Types of Bars

There are three main types of gold bars sold at Provident Metals.

- Cast: Cast bars represent how the earliest civilizations made metal bars. Metal is poured into a mold and heated. Once the bar is cooled it is removed from the mold with information or design elements being stamped into, usually, just one side.

- Hand-Poured: These bars are similar to cast bars in that metal is poured into a mold. However, one side of the mold is exposed. These bars look like they were made by hand.

- Minted Ingot: These bars differ greatly from how cast and hand-poured bars are made. Bars start off as blanks. This means that they’re in the shape of the bar but with no inscriptions or design elements. A machine then uses thousands of pounds of pressure to put the design elements onto the blank.

Popular Gold Bar Producers

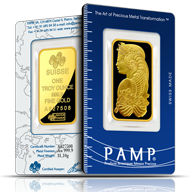

- PAMP Suisse: This Switzerland-based refinery was established in 1977 and creates some of the more recognizable gold bars in the world today. PAMP Suisse is known for its Fortuna, Rosa, and Lunar Series of gold bars.

- Perth Mint: The Perth Mint is the oldest running mint in all of Australia. They’re known for their line of gold bars featuring a repeating pattern of Kangaroos on the back.

- Royal Canadian Mint: The Royal Canadian Mint (RCM) is known for its gold bullion products as they’re one of the more popular sovereign mints in the world. Most of their gold bars have added security features commonly found in their Canadian Maple Leaf Gold Coins.

- Argor-Heraeus: Established in Switzerland in 1951, this once-private company joined the German Heraeus Group in 1986. Among their array of products are unique gold bars such as the Lunar series and the Kinebar collection.

- Valcambi: Also founded in Switzerland, Valcambi has some of the most unique gold bars on the market today. Valcambi is known for its generic gold bars with its logo, its cast bars, and CombiBars.

- Credit Suisse: This publicly traded bank in Switzerland is known for its unique gold bars and cast gold bars in an array of sizes.

- Germania Mint: The origins of this now well-known mint can be traced back to 1986 when it started as a numismatic store in Poland. The family business has now evolved into a 200-person company providing people with some of the best gold bullion products out there today. Germania Mint is known for its array of cast gold bars.

- The Holy Land Mint: The Holy Land Mint is a brand under the Israel Coins and Medal Corporation. After the ICMC was privatized, they created The Holy Land Mint to supply people with investment products from Israel. Among their gold bars offered are their Dove of Peace gold bars.

- Scottsdale Mint: This private mint in the US creates foreign coinage as well as gold bars. They offer a wide range of gold-minted ingots as well as cast bars.

Popular Sizes

Provident Metals offers a wide array of gold bars in unique sizes. While 1 oz and 1 oz bars are among the most popular, we offer bars ranging from 1 Gram to 1 Kilogram. At Provident Metals, we offer gold bars in the following weights:

- 1 Gram (0.03215 Troy oz)

- 5 Grams (0.08038 Troy oz)

- 5 Grams (0.16075 Troy oz)

- 10 Grams (0.32151 Troy oz)

- 20 Grams (0.64302 Troy oz)

- 1 oz

- 50 Grams (1.60754 Troy oz)

- 100 Grams (3.21507 Troy oz)

- 10 oz

- 1 Kilogram (32.1507 Troy oz)

Buying Gold Bars at Provident Metals

Provident Metals will always have an array of unique gold bars to choose from. For any inquiries you have on these products or others, don’t hesitate to give us a call at 800-313-3315. Additionally, our team can be reached via email or through our online chat feature.